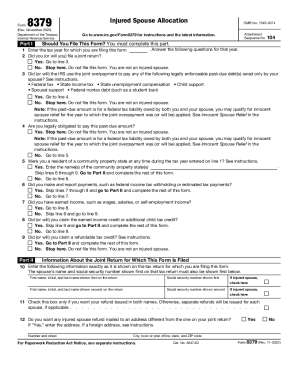

IRS 8379 2021 free printable template

Instructions and Help about IRS 8379

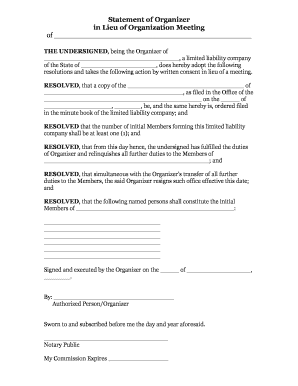

How to edit IRS 8379

How to fill out IRS 8379

About IRS 8 previous version

What is IRS 8379?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8379

What should I do if I need to correct a mistake on my IRS 8379 after filing?

To correct any mistakes on your IRS 8379 after it has been filed, you will need to submit an amended return. This involves filing a new IRS 8379 along with a cover letter that explains the corrections. Ensure that you reference the original submission and include any supporting documents that help clarify the changes.

How can I check the status of my IRS 8379 submission?

You can verify the status of your IRS 8379 submission by using the IRS ‘Where’s My Refund?’ tool online or by calling the IRS directly. Keep in mind that processing times can vary, and checking during peak periods may lead to delays in updates. Be prepared with your social security number and other relevant identification details.

Are there any special considerations for filing IRS 8379 for nonresidents?

When filing IRS 8379 for nonresidents, it's important to ensure that the appropriate forms are used, as nonresident aliens may have different tax obligations. You should be aware of any additional documentation required and possibly consult with a tax professional familiar with international tax laws to avoid common pitfalls.

What are some common errors that filers make when submitting IRS 8379?

Common errors include incorrect taxpayer identification numbers, failure to sign the form, and not checking for accurate calculations on the form. To avoid these mistakes, carefully review your completed IRS 8379 before submission and cross-check all required information against official records.

What should I do if I receive a notice from the IRS regarding my IRS 8379?

If you receive a notice related to your IRS 8379, it is crucial to respond promptly as instructed. Gather the requested documentation and provide any necessary clarifications. Consulting with a tax professional can also help you understand the implications of the notice and how best to address it.